The Hidden Tax on Climate Action

The carbon credit market faces a paradox: while designed to fight climate change, its structure often enriches intermediaries more than the communities protecting forests or the companies funding conservation. Project developers receive as little as 10-20% of the final sale price of carbon credits, with the rest captured by a chain of brokers, registries, and trading platforms.

This isn't a bug—it's the natural result of information asymmetry. In a market where finding the "right" carbon credit costs more than the credit itself, middlemen who control information flow capture outsized value. Meanwhile, rainforest communities in Brazil wait months for payment, and corporations struggle to verify if their offsets actually sequester carbon.

What if there was a better way? What if carbon markets could learn from DeFi's most innovative trading protocol?

Enter CoW Protocol: Rethinking Market Making

CoW Protocol (Coincidence of Wants) represents a paradigm shift in decentralized trading. Instead of traditional automated market makers (AMMs) where traders pay fees to liquidity providers, CoW Protocol matches orders directly between traders whenever possible—a "peer-to-peer swap" that eliminates unnecessary intermediation.

Here's how it works:

CoW Protocol's batch auction mechanism: orders flow through solver competition to optimal execution

CoW Protocol Mechanism

- Batch Auctions: Orders are collected over a short time period

- Solver Competition: Multiple "solvers" (specialized market makers) compete to find the best execution

- CoW Matching: The protocol first attempts to match buyers and sellers directly

- Surplus Distribution: Any efficiency gains are returned to traders, not captured by the protocol

The result? Traders often receive better prices than they would on traditional DEXs, while paying lower fees. The protocol's design aligns incentives: solvers only profit when they provide genuine value.

The Carbon Market's Middleman Problem

Carbon markets suffer from what economists call "search costs"—the expense of finding and verifying suitable trading partners. Consider the journey of a carbon credit:

Value leakage in carbon markets: costs escape through multiple inefficiencies

Supply Side (Project Developers)

- Forest conservation project in the Amazon spends $5/ton to generate credits

- Must pay registry fees ($1-2/ton) to certify credits

- Lacks direct access to corporate buyers

- Receives $8-12/ton from broker

Demand Side (Corporate Buyers)

- Corporation wants high-quality forest carbon credits

- Pays consultant ($50k+) to evaluate projects

- Pays broker $30-40/ton for verified credits

- Struggles to verify additionality and permanence

The Middlemen

- Carbon brokers capture $18-28/ton spread

- Information asymmetry is their competitive advantage

- Little incentive to make markets more transparent

- Market concentration among few large players

Studies show that transaction costs can represent 30-50% of carbon credit prices, with information costs being the largest component. This isn't just inefficient—it's a structural barrier to scaling climate action.

A CoW Protocol for Carbon Credits: The Vision

Imagine a "CoW Protocol for Carbon" that applies the same principles to regenerative markets:

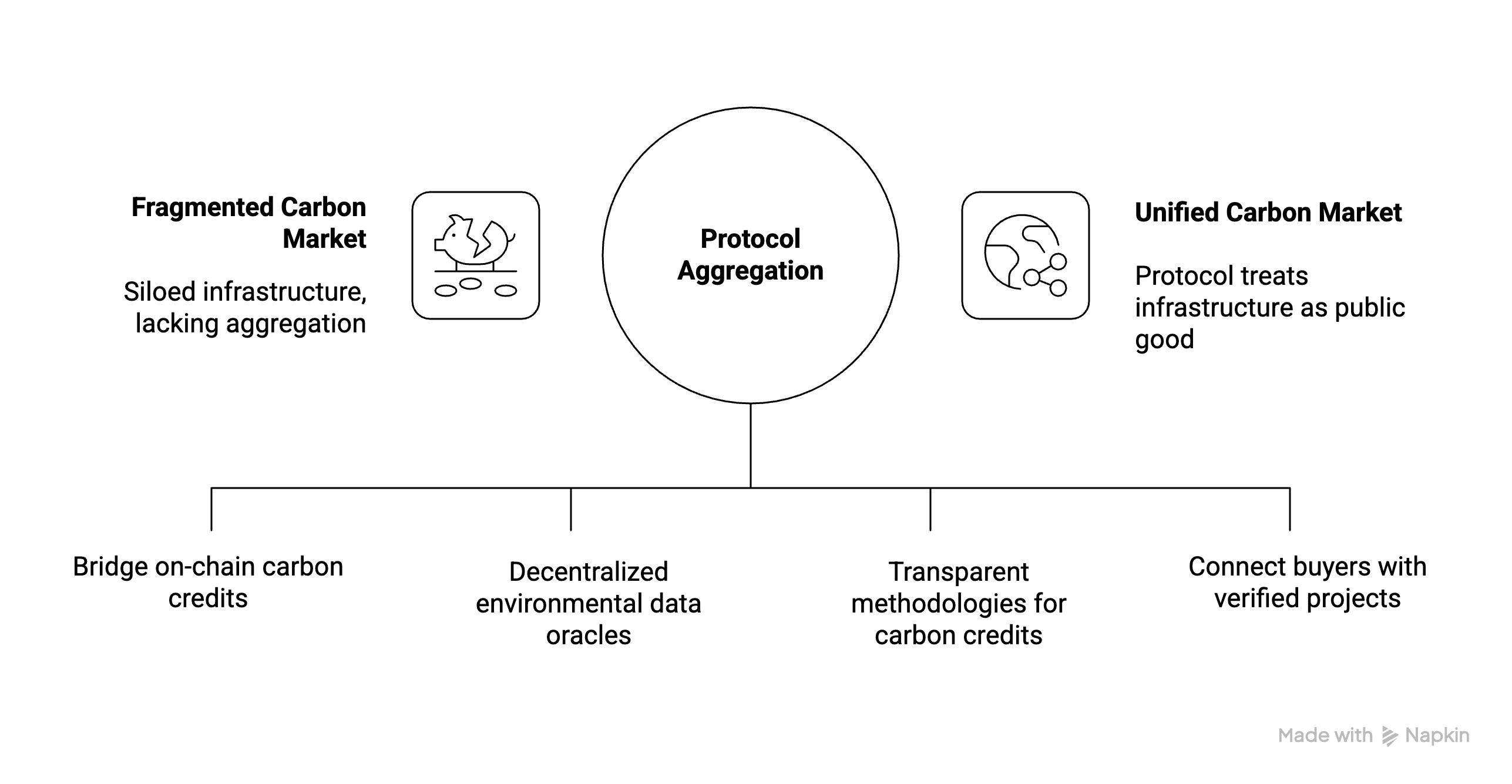

Protocol aggregation transforms fragmented carbon markets into unified, transparent infrastructure

1. Aggregation Over Fragmentation

Instead of dozens of disconnected marketplaces, a unified aggregator that:

- Connects all major carbon registries (Verra, Gold Standard, ACR, etc.)

- Indexes high-quality projects by type, methodology, and verification level

- Provides real-time pricing across all available credits

2. Direct Matching Before Market Making

Like CoW's peer-to-peer swaps:

- Match qualified buyers directly with project developers when preferences align

- Only route through intermediaries when direct matching isn't possible

- Distribute efficiency gains to buyers and sellers, not middlemen

3. Transparent Quality Verification

On-chain verification that addresses information asymmetry:

- Immutable record of project documentation and third-party audits

- Real-time monitoring data from satellite imagery and IoT sensors

- Decentralized rating systems that can't be gamed by any single actor

4. Competitive Market Making

When intermediation is necessary:

- Multiple "solvers" compete to provide best execution

- Transparent fees and value-add (due diligence, bundling, insurance)

- Reduced margins through competition

Why This Matters for Regeneration Markets

The implications extend beyond carbon credits:

For Project Communities

Latin American communities protecting rainforests could receive 40-60% more per credit—resources that fund education, healthcare, and alternative livelihoods. Higher margins also make smaller projects economically viable, enabling more localized conservation efforts.

For Corporations

Companies spend millions on carbon market consultants largely to navigate information asymmetry. A transparent aggregator would reduce these costs while improving credit quality verification—addressing the growing scrutiny of corporate climate claims.

For Market Integrity

Transparency doesn't eliminate intermediaries—it forces them to compete on value creation rather than information control. Brokers who provide genuine services (project development support, risk assessment, portfolio construction) would thrive. Those extracting rents purely from opacity would not.

Building Blocks Already Exist

The infrastructure for this vision is emerging:

- Registry Integration: Toucan Protocol and KlimaDAO have demonstrated on-chain carbon credit bridging

- Verification Infrastructure: dClimate and other projects are building decentralized environmental data oracles

- Standards Frameworks: Open Earth Foundation is developing transparent methodologies

- Demand Aggregation: Platforms like Puro.earth are already connecting buyers directly with verified projects

What's missing is the "aggregator of aggregators"—a protocol that treats carbon market infrastructure as a public good rather than a moat.

The Road Ahead

This series will explore how DeFi primitives can transform regenerative markets:

Series: DeFi Infrastructure for Regenerative Finance

- Part 1: What the Carbon Credit Market Can Learn from CoW Protocol (You are here)

- Part 2: Automated Market Makers for Biodiversity Credits

- Part 3: Lending Protocols for Regenerative Agriculture

- Part 4: Prediction Markets for Climate Outcomes

- Part 5: Stablecoins Backed by Natural Capital

Each piece will examine both the technical architecture and the real-world coordination challenges. Because the goal isn't just better financial infrastructure—it's channeling capital toward genuine ecological restoration at a scale that matters.

The carbon market's middleman problem isn't unique to climate. Information asymmetry plagues every regenerative market, from biodiversity credits to sustainable supply chains. But if we can solve it for carbon—the largest and most scrutinized regenerative market—we create a template for everything else.

CoW Protocol showed us that you can build markets where efficiency gains flow to participants, not intermediaries. Now it's time to apply that lesson where it matters most: funding the transition to a regenerative economy.